Focused: Financial Advice for CAF Members & their Families

Canadian Armed Forces (CAF) personnel face a myriad of complex financial circumstances that other Canadians do not. From a seemingly overly complicated compensation system to pay enhancements due to particular duties or geographic location, and of course, the drastic cost of living along with the income changes from one posting to another.

Canadian Armed Forces (CAF) personnel face a myriad of complex financial circumstances that other Canadians do not. From a seemingly overly complicated compensation system to pay enhancements due to particular duties or geographic location, and of course, the drastic cost of living along with the income changes from one posting to another.

The challenges are numerous, making financial planning and decision-making uniquely tricky. I believe that the following information may help to enhance the financial literacy required by all Canadians in order to make sound financial decisions when managing one’s financial affairs.

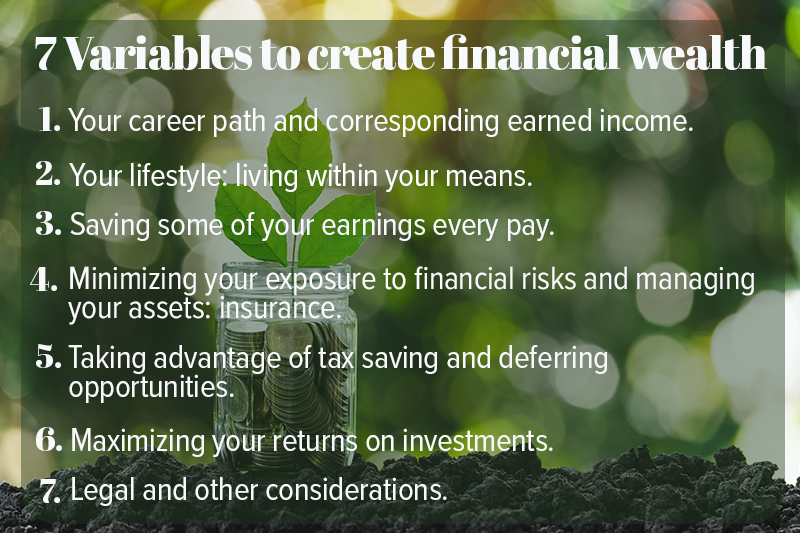

Seven Variables

Be aware that there are only seven variables that can be manipulated or managed in creating your financial health and security. The first three variables are entirely within your ability to control by making wise, informed decisions (yes, life may throw you a curveball, but you control your response to the unforeseen).

Your number one determinant of financial success and wealth building starts with your career and value to your employer. Advice number one is always to add more skill sets to your repertoire so that you become invaluable to your employer.

Live within Your Means

Your spending habits must be based on the old adage: “Live within your means,” which loosely translates to: “Don’t spend more than you earn!”

Savings, which are the foundation for wealth accumulation and financial security, are also critical. Are you putting aside three to 10 per cent of your net income every pay?

If not, consider building a financial safety net for those just in case situations when the furnace needs to be replaced, the car breaks down, or another unforeseen expense arises. Most people are interested in being comfortable in life with a focus on attaining a desired standard of living for their ideal vision of retirement.

First Step: Creating Financial Independence

The first step in creating financial independence is the ability to live on less than your earned income. The discipline in doing so is the same whether you are earning an income of $30,000 or more than $100,000. The other four variables should involve the use of trusted, third-party advisors. Minimizing risk can affect both the assets you have, such as a home, and your ability to sustain your standard of living should your income be interrupted.

These strategies can include protection plans such as life and disability insurance, critical illness medical benefits, and out-of-country travel insurance, among others. If any of these risks should affect you or your family, it will affect your current style of living and may influence your potential retirement date and leisure activities.

Tax Planning

Tax planning is also essential since it affects the amount of money left over to fund your current activities and savings ability. It can be as simple as taking advantage of all the deductions you qualify for when filing your annual income tax return, like taking full advantage of Registered Retirement Savings Plans (RRSP) and Tax Free Savings Account (TFSA).

TFSA really should have been called Tax Free INVESTMENT Account. These are great strategies to achieve your goals. Collaborating with a trusted advisor is highly recommended, but be careful not to let the tax planning become the focus of your entire financial strategy! Managing your investments to protect and earn a return on your capital is crucial to assist you in achieving the level of overall savings from which to fund or enhance your retirement and other financial goals.

Legal Aspects

Finally, you need to pay attention to the legal aspects and other areas that can affect your financial affairs. The most basic set of documents are a will, and power of attorney, both general and an enduring or continuing power of attorney. These items form the context for managing your life.

I repeat: the advice and support of qualified specialists will ensure your wishes are fulfilled. Some simple financial strategies will help you get and stay on track to optimize your plans, designed for your unique situation, values, and concerns.